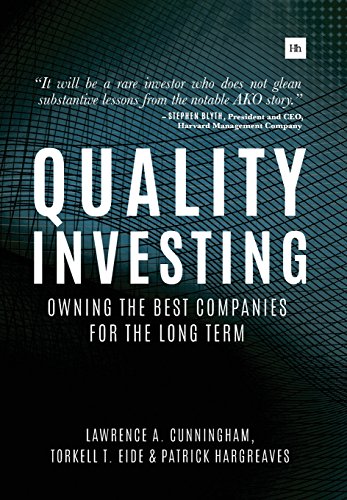

Quality Investing: Owning the best companies for the long term Hardcover – January 5, 2016 by Lawrence A Cunningham, Torkell T Eide, Patrick Hargreaves

Hardcover

[224 Pages]

PUB:January 05, 2016

Description

Author: Cunningham Lawrence A

Brand: Harriman House

Edition: 1

Package Dimensions: 21x241x180

Number Of Pages: 224

Release Date: 05-01-2016

Details: Product Description

The concept of quality is familiar. People make judgments about it every day. Yet articulating a clear definition of quality is challenging. The best companies often appear to be characterized by an ineffable something, much like that of people who seem graced by a lucky gene. Think about those of your peers who seem a lot like you but somehow always catch a break. They are not obviously smarter, smoother, richer, or better-looking than you, yet they are admitted to their university of choice, get their dream job, and earn considerable wealth. Try to discern what they have that you don’t, and you are stumped. Chalk it up to fate or plain dumb luck. Businesses can be similar. For reasons that are not always evident, some end up doing the right things with better results than average. They may not appear to be savvier acquirers, more adept marketers, or bolder pioneers, yet they integrate new businesses better, launch products more successfully, and open new markets with fewer mishaps. Perhaps through some combination of vision, scale, or business philosophy, these companies uncannily come out ahead. In our view, three characteristics indicate quality. These are strong, predictable cash generation; sustainably high returns on capital; and attractive growth opportunities.

Review

“Investing is a continuous process of learning, and it will be a rare investor who does not glean substantive lessons from the notable AKO story of quality investing.”;-

Stephen Blyth, President and CEO, Harvard Management Company, Professor of the Practice of Statistics, Harvard University;

“Capturing both the science and the art that have driven AKO’s success, Quality Investing is equal parts investing handbook and ode to the beauty of truly great businesses.”;

Peter H. Ammon, Chief Investment Officer, University of Pennsylvania;

“Quality Investing answers the riddle of what you get when you cross Peter Lynch’s One Up on Wall Street with Seth Klarman’s Margin of Safety. By combining a discerning eye for sustainable growth with a disciplined calculus to buy over horizons when the probabilities are favorable, the book articulates a profitable approach to the art of investing.”-

Jason Klein, Senior Vice President & Chief Investment Officer, Memorial Sloan Kettering Cancer Center;

“I recommend Quality Investing highly as a guide to harness the power of core investment principles. Shows why the best long-term ‘margin of safety’ comes not from an investment’s price but from the value of a company’s competitive advantage.”;-

Thomas A. Russo, Partner, Gardner, Russo & Gardner;

“Quality Investing, from a team of top quality investors, provides a clear and rigorous analysis of a highly successful, long-term investment strategy. In an increasingly short-term investment world, the book’s insights are likely to remain hugely valuable.”;-

Neil Ostrer, Founder, Marathon Asset Management;

“Quality Investing describes a unique approach to evaluating investment opportunities based on real life examples and experience. Replete with interesting lessons and insights relevant not just for investors, but for any business leader seeking to build an enduring, high-quality company, Quality Investing is an outstanding book and should be required reading for business leaders and MBA students as well as for investors.”;-

Henrik Ehrnrooth, President & CEO, KONE;

“The book is a crisply-written mix of sound investment principles, insightful commercial patterns, and colorful business cases. A real pleasure to read.”;-

Hassan Elmasry, Founder and Lead Portfolio Manager, Independent Franchise Partners;

“AKO Capital were one of the first to recognise Ryanair’s secret formula…An outstandingly handsome CEO, a brilliant strategy, all underpinned with our innate humility. These guys are geniuses. For a better life you must read this book…and fly Ryanair!!”;-

Michael O’Leary, Chief Executive, Ryanair;

“Quality counts. If you are a long term investo

Be the first to review “Quality Investing: Owning the best companies for the long term Hardcover – January 5, 2016 by Lawrence A Cunningham, Torkell T Eide, Patrick Hargreaves”

You must be <a href="https://webdelico.com/my-account/">logged in</a> to post a review.

There are no reviews yet.