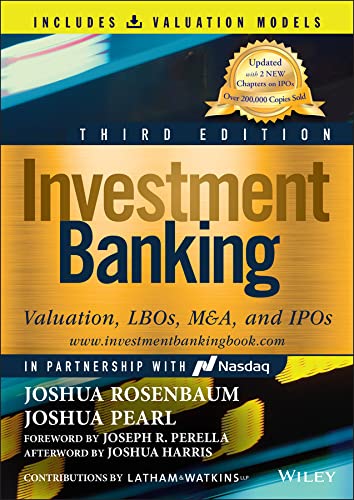

Investment Banking: Valuation, LBOs, M&A, and IPOs (Book + Valuation Models) (Wiley Finance) Hardcover by Joshua Rosenbaum

HARDCOVER

[512 pages]

PUB: February 08, 2022

Description

Author: Pearl Joshua

Edition: 3

Package Dimensions: 0x0x666

Number Of Pages: 512

Release Date: 12-01-2022

Details: Product Description

Praise for Investment Banking

“This book will surely become an indispensable guide to the art of buyout and M&A valuation, for the experienced investment practitioner as well as for the non-professional seeking to learn the mysteries of valuation.”

—David M. Rubenstein, Co-Founder and Co-Executive Chairman, The Carlyle Group Host, The David Rubenstein Show: Peer to Peer Conversations

“The two Joshes present corporate finance in a broad, yet detailed framework for understanding valuation, balance sheets, and business combinations. As such, their book is an essential resource for understanding complex businesses and capital structures whether you are on the buy-side or sell-side.”

—Mitchell R. Julis, Co-Chairman and Co-CEO, Canyon Partners, LLC

“Investment Banking provides a highly practical and relevant guide to the valuation analysis at the core of investment banking, private equity, and corporate finance. Mastery of these essential skills is fundamental for any role in transaction-related finance. This book will become a fixture on every finance professional’s bookshelf.”

—Thomas H. Lee, President, Lee Equity Partners, LLC Founder, Thomas H. Lee Capital Management, LLC

“As a pioneer in public equities, Nasdaq is excited to be partnering with Rosenbaum and Pearl on Investment Banking as they break new ground on content related to IPOs, direct listings, and SPACs. We recommend the book for any shareholder and senior executive looking to take a company public, as well as their bankers and lawyers.”

—Adena Friedman, President and CEO, Nasdaq

“Investment banking requires a skill set that combines both art and science. While numerous textbooks provide students with the core principles of financial economics, the rich institutional considerations that are essential on Wall Street are not well documented. This book represents an important step in filling this gap.”

—Josh Lerner, Jacob H. Schiff Professor of Investment Banking, Harvard Business School Co-author, Venture Capital and Private Equity: A Casebook

“Valuation is the key to any transaction. Investment Banking provides specific step-by-step valuation procedures for LBO and M&A transactions, with lots of diagrams and numerical examples.”

—Roger G. Ibbotson, Professor in the Practice of Finance, Yale School of Management Chairman and CIO, Zebra Capital Management, LLC Founder, Ibbotson Associates

“Investment Banking provides fresh insight and perspective to valuation analysis, the basis for every great trade and winning deal on Wall Street. The book is written from the perspective of practitioners, setting it apart from other texts.”

—Gregory Zuckerman, Special Writer, The Wall Street Journal Author, The Greatest Trade Ever, The Frackers, and The Man Who Solved the Market

From the Inside Flap

A timely update to the global bestselling book on investment banking and valuation

In the constantly evolving world of finance, a solid technical foundation is an essential tool for success. Due to the fast-paced nature of this world, however, no one was able to take the time to properly codify its lifeblood—namely, valuation and dealmaking. Rosenbaum and Pearl originally responded to this need in 2009 by writing the first edition of the book that they wish had existed when they were trying to break into Wall Street.

Investment Banking: Valuation, LBOs, M&A,and IPOs, Third Edition is a highly accessible and authoritative book written by investment bankers that explains how to perform the valuation work and financial analysis at the core of Wall Street—comparable companies, precedent transactions, DCF, LBO, M&A analysis … and now IPO analytics and valuation. Using a step-by-step, how-to approach for each methodology, the authors build a chronological knowledge base and define key terms, financial concepts, and processes throughout the book.

The genesis for the original book stemmed from the authors’ personal experiences as students intervi

Be the first to review “Investment Banking: Valuation, LBOs, M&A, and IPOs (Book + Valuation Models) (Wiley Finance) Hardcover by Joshua Rosenbaum”

You must be <a href="https://webdelico.com/my-account/">logged in</a> to post a review.

There are no reviews yet.